Winds of change are blowing for everyone, and social sector organizations are no exception. While their raison d’être and the causes they fight for are becoming increasingly important, their operational and financing models have become outdated.

Traditional funding channels, which rely heavily on public and private donors, have proven insufficient and often unstable. In Spain, for example, between 80% and 95% of NGO funding came from public grants. This model, although it allowed the development of numerous projects, also created a dependency that limited the autonomy of organizations and left little room for effective project implementation (many project directors spend half their time seeking funds and 30% justifying expenses).

In this situation, the global financial crisis of 2008 marked a turning point in the third sector financing model. The drastic reduction of public and private funds forced NGOs to seek new forms of financing. During this period, work was being done on the Millennium Development Goals, which, although achieving certain progress, were not fully met. This partial failure revealed a significant funding gap necessary to reach these goals. UNCTAD estimated an annual gap of 2.5 trillion dollars between the available funds and those needed to meet the Sustainable Development Goals (SDGs).

The solution to this funding gap involved a paradigm shift: attracting traditional private capital and seeking more flexible and sustainable financing forms. This new approach aims to combine investment and philanthropy, under the concept of impact investing, which seeks to make money and do social good simultaneously.

Impact investing involves using private sector business models to solve social problems, thus attracting the necessary capital to meet the SDGs. This approach requires a creative and innovative mindset, and above all, close collaboration between various actors.

Impact investing involves using private sector business models to solve social problems, thus attracting the necessary capital to meet the SDGs.

What Do We Mean by Alternative Financing?

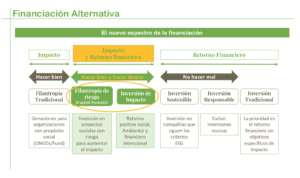

The spectrum of financing encompasses a wide range of approaches, from those seeking exclusively financial returns to those prioritizing only social or environmental impact. Between these two options, there is a wide range we will explain below.

As mentioned, at one end of the spectrum is traditional philanthropy. This type of financing focuses solely on doing good. Donors provide funds without expecting a financial return, focusing only on generating a positive impact on society or the environment. Donations are the clearest example of traditional philanthropy.

At the other end, we have traditional investment, where the primary goal is to obtain a financial return. In this case, investors seek to maximize their financial benefits without considering the social or environmental impact of their investments. A typical example of traditional investment is investing in the stock market.

Between these two extremes, there are several forms of financing that combine different degrees of social impact and financial return. Responsible investing is one of them. Here, investors seek a financial return but avoid causing harm by excluding industries considered harmful, such as oil or weapons. Although they do not have a specific social impact objective, they filter and exclude investments they consider detrimental.

A step further is sustainable investing. In this case, investors seek both a financial return and compliance with environmental, social, and governance (ESG) criteria. Investments are made in companies that meet high standards of corporate social responsibility and environmental sustainability.

Venture philanthropy, also known as venture philanthropy, is another approach within the financing spectrum. This type of philanthropy is characterized by taking high risks to achieve high social impact. Investors are willing to take significant risks to fund innovative ideas that have the potential to generate a significant social impact. They often invest in social projects that are in initial or pilot phases.

Finally, impact investing combines the pursuit of financial return with generating positive social or environmental impact. Impact investors intentionally seek a positive social or environmental return, as well as a financial return, which can be in line with or even below market rates. This form of investment represents a paradigm shift, as it tries to bring together the worlds of financial investment and philanthropy to find common ground and collaborate on projects that benefit both society and investors.

It is in these last two types of investment where we will find the bulk of what we call alternative financing. Below, we will see how this type of financing materializes from both public and private sources.

Private Sector Alternative Financing

Crowdfunding: The Power of Many

Crowdfunding is one of the most popular and accessible forms of alternative financing. This model allows organizations to raise small amounts of money from a large number of people over the internet. By donating, participants often receive rewards or incentives, such as exclusive products, special mentions, shares in the company, or a return on investment. Platforms like Kickstarter and GoFundMe are prominent examples of how crowdfunding can be implemented.

Crowdfunding not only provides funds for projects but also creates a community of supporters and potential advocates for the cause. This community can be crucial for the project’s long-term success, providing continuous support and increasing the project’s visibility.

Some educational initiatives have successfully used crowdfunding to finance their projects and expand their impact, such as Bridge International Academies, a business model that creates networks of low-cost schools in Africa, or Laboratoria, a social enterprise that trains young women in programming and web development skills in Latin America.

Social Impact Funds: Investing for Good

Another promising avenue of alternative financing is social impact funds. These are investment funds that invest in projects seeking positive social and environmental impact, in addition to a financial return. The keys to accessing these funds are having projects with scalability and long-term sustainability potential, the ability to generate a financial return in addition to social impact, and a clear exit plan for investors. It is a way to attract capital from investors who want to see tangible results and economic benefits.

Organizations like the Rise Fund, created by Bono of U2, Acumen, and the Calvert Fund have supported innovative educational projects in Latin America and Africa, such as Bridge International Academies or Dreambox Learning.

Migrant Remittances: Capitalizing on Money from Abroad

Migrant remittances represent a significant source of income for many developing countries. Some governments have started channeling these remittances into social projects. For example, in Mexico, the “3×1 for Migrants” program triples each peso sent by migrants to fund educational and infrastructure projects. In El Salvador, remittances are used to fund educational scholarships for low-income individuals. This approach not only leverages existing resources but also fosters a sense of responsibility and participation among migrant communities.

Strategic Alliances: Collaborating to Innovate

Strategic alliances with private companies are another vital source of funding. Many companies have corporate social responsibility programs that can align with the goals of NGOs. In the digital education field, companies like Microsoft, Intel, and IBM have supported projects aiming to close the digital divide in disadvantaged communities. These alliances provide not only funds but also technological knowledge and resources that can amplify the projects’ impact.

Public Sector Alternative Financing

Social Impact Bonds: Paying for Success

Social Impact Bonds (SIBs) represent a significant innovation in financing social projects by combining private financing with public goals. In this model, private investors advance the money for projects addressing specific social problems. If the project meets predetermined objectives, a payer (usually the government or a foundation) reimburses the investors.

In this model, there are typically three actors: a public administration with a social problem, an NGO or foundation that knows how to solve it, and an investor who advances the money. An external evaluator is also needed to measure if the objectives defined at the beginning have been achieved, and a clear agreement on the results to be achieved and the payment mechanisms.

A notable example is the Social Impact Bond of Educate Girls in India, the world’s first social impact bond in education, which significantly improved access to and performance in school for girls in Rajasthan.

Social Development Bonds: Intervention in Emergency Contexts

Social Development Bonds (SDBs) operate similarly to Social Impact Bonds but specifically address urgent needs in emergency contexts. In this case, the payer is not a government but a foundation or a development financial institution, such as the IDB or CAF in Latin America, or the AfDB in Africa.

Public-Private Partnerships: Financial Synergies

In this type of alliance, public and private funds are combined to attract and capitalize investments. This approach is based on the premise that, although private capital seeks profitability and generally avoids risk, it is possible to manage this risk using public funds.

To achieve this, different financial mechanisms are employed. Donations, guarantees, first-loss coverage, and technical assistance are some of the tools used to assume risks that private investors are not willing to take. This makes the investment more attractive to the private sector, encouraging its participation in high social impact projects.

A concrete example of this type of alliance has been implemented in Spain with the Huruma Fund, managed by GAWA, focused on the agricultural sector in Africa. In this case, GAWA raises funds from private investors and channels them to microfinance institutions, social enterprises, and other organizations that implement the projects.

This model has raised nearly 120 million dollars for agricultural investments in Africa. Of this total, 80 million come from private investors, incentivized to participate because the Spanish Agency for International Development Cooperation (AECID) contributes 20 million to cover possible losses, and the European Union adds another 10 million to cover additional losses and provide technical assistance. This structure ensures that the projects work correctly and reduces the risk for private investors.

The concept can be applied on a smaller scale. The main idea is to use public funds to mitigate risk, so private capital can be attracted, achieving more effective and sustainable financing for projects that would otherwise not receive significant investments.

Exploring these alternative funding avenues requires a shift in mindset. Organizations must be creative, innovative, and patient. The transition to these new funding models is not easy, but it is necessary to ensure the sustainability and independence of social organizations.

Keys to Accessing Alternative Financing

What criteria must be met to access these new forms of financing? We list the most important ones:

- Have a clear social and environmental impact.

- Present a financially viable and scalable model.

- Demonstrate the project’s sustainability beyond the initial financing.

- Incorporate innovation in the project’s design and execution.

- Measure and evaluate social impact rigorously.

A Necessary Mindset Shift

Exploring these alternative financing avenues requires a mindset shift. Organizations must be creative, innovative, and patient. Transitioning to these new financing models is not easy, but it is necessary to ensure the sustainability and independence of social organizations. NGOs must develop scalable, sustainable, and innovative projects with a clear social and environmental impact to attract new types of investors.

The money is out there, waiting to be channeled towards the causes that need it most. With the right strategy, social organizations can open new financing avenues that will not only ensure their survival but also enhance their capacity to transform the world.