What is money? Who creates it? How is it distributed? What about savings, inflation, borrowing, repayments and the interest rate? In recent years, social, economic and demographic changes have made financial decision-making more difficult. The financial markets have become more complex due to the existence of new distribution channels and products, which has increased the risk for consumers. Managing the financial resources of individuals and households has become more complicated, requiring greater skills and knowledge compared to previous generations. We know, and the OECD confirms, that poor financial decisions can have a lasting impact on individuals, their families and society.

Unfortunately, the absence of basic financial knowledge is a reality that affects numerous people, exposing them to financial risks and restricting their opportunities. Thus, according to the data of the OECD, only 27% of young adults in the United States are familiar with concepts such as inflation and risk diversification and doing simple interest calculations, only 41% people in Peru can add 2% interest to initial savings totalling 100 Peruvian soles and 73% people in Denmark have little or no knowledge of interest rates. Meanwhile, 52% of British teenagers fall into debt by the age of 17.

Within this context, financial education becomes increasingly relevant. The adults of tomorrow will need to know, for example, how to budget and make smart financial decisions for their everyday lives, and they’ll also need to manage risks (e.g. avoiding taking on unmanageable debt) and plan for their old age.

In this article we’ll examine what financial education involves, what its benefits are, why it’s particularly necessary in vulnerable countries and what results teaching it at schools produces.

Managing the financial resources of individuals and households has become more complicated, requiring greater skills and knowledge compared to previous generations.

What it is (and what to teach)

Financial education is the set of knowledges and skills required to understand and effectively manage issues related to money and personal finances. It provides us with the necessary tools for making informed and responsible financial decisions throughout our lives.

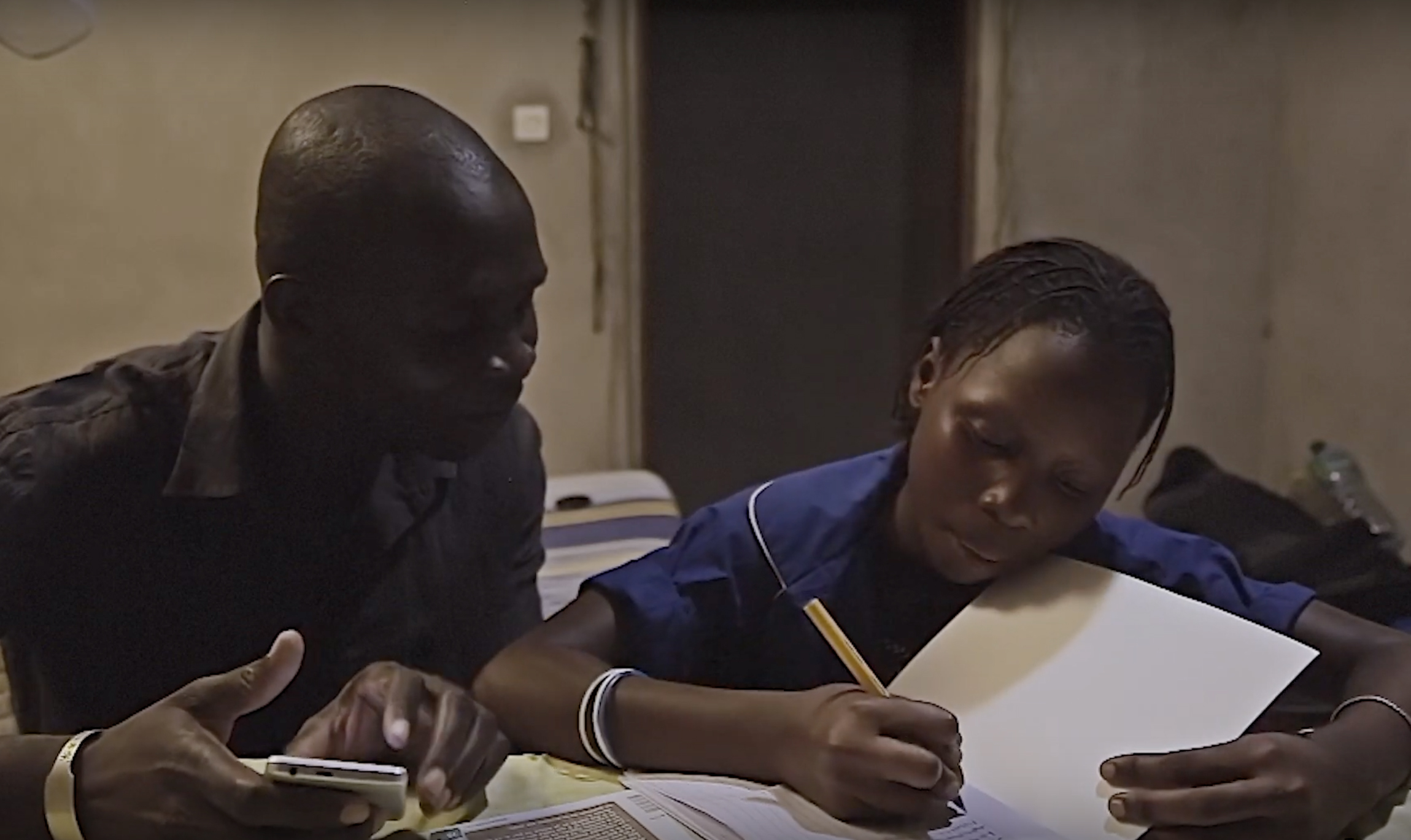

In 2005, the OECD recommended the early inclusion of financial education in the school curriculum. Including financial education in the school curriculum is a fair and effective policy tool. Financial education is a long-term process and its incorporation into the curriculum at an early age allows children to acquire the knowledges and skills required to develop responsible financial behaviour throughout their education. This measure is particularly crucial, as many parents may lack the resources needed to teach their children about money, given that financial literacy levels are generally low around the world.

Financial education covers a wide range of topics including, but not limited to:

- Basic financial concepts such as income, expenses, savings, debts, budgeting and other money-related concepts.

- Savings and investments: it’s important to learn how to set financial goals, develop savings habits, understand the concepts of interest and return and explore different forms of investment.

- Responsible indebtedness: understanding concepts related to indebtedness such as interest, payment terms and the consequences of debt. This also involves learning to use credit responsibly and avoiding over-indebtedness.

- Long-term financial planning: the ability to plan for long-term financial goals, such as buying a home or retirement, and developing strategies to achieve these goals.

How to do it

In keeping with the OECD’s 2005 recommendations, more and more countries are acknowledging the importance of financial education and including it in their school curricula and, although there is no single recipe for success, the ones that have made the most progress have adopted the guidelines endorsed by the OECD and its International Network on Financial Education (INFE). What are these guidelines?

- Coordinated national strategy. Financial education at schools should form part of a coordinated national strategy with a visible leader or a coordinating body to ensure its long-term relevance and sustainability. The education system and the profession should take part in the development of the strategy.

- Learning framework. A learning framework must be established to define the objectives, learning outcomes, contents, pedagogical approaches, resources and evaluation plans. This framework may be a national, regional or local one and should encompass knowledges, skills, attitudes and values.

- Sources of funding. It’s important to identify sustainable sources of funding for the implementation of financial education from the outset.

- From the beginning to the end. Financial education should begin as soon as possible, preferably at the beginning of formal schooling, and last until the end of the students’ school years.

- Included in the curriculum. Financial education should ideally form part of the curriculum. It can be taught as a standalone subject, but it can also be effectively integrated into other subjects such as mathematics, economics, social sciences and citizenship. Financial education can offer a series of “real life” contexts in different subjects.

- Suitable teacher training. It’s essential for teachers to receive the appropriate training, as well as the resources required to teach financial education. They must understand the importance of this subject and be familiar with the relevant pedagogical methods. It’s also vital for them to receive ongoing support and training in order to improve their teaching skills in the field of financial education.

- Accessible tools and resources. It’s essential to provide easily accessible, objective, high-quality and effective learning tools and pedagogical resources for schools and teachers to use. These resources must be suited to the level of study of the students and be appropriate for their understanding and application.

- It’s important to assess the students’ progress in financial education and recognise their achievements. The evaluation provides feedback for both the students and the teachers, allowing them to identify areas for improvement and reinforce the knowledge acquired.

What about vulnerable countries?

Financial education in developing countries plays a crucial role because, in addition to enhancing people’s financial skills and knowledge, it contributes to promoting financial inclusion, one of the pillars of global development, and sustainable economic development. As stated in this IDB article, the efforts of the governments of these countries geared towards creating more accessible banking networks and easier payment systems and, in general, improving financial inclusion should also be aimed at improving the financial literacy of their citizens.

In these countries, the citizens’ mistrust and their lack of knowledge of the financial systems is a serious hindrance that can only be alleviated through education. For example, in Latin America and the Caribbean only 9.6% of the population requests a loan from a financial institution and the private savings rates stand at 14.7%. These data profoundly affect the vitality of the economies, as they stagnate productivity and impede growth.

Moreover, according to PISA, disadvantaged students display lower levels of financial literacy. The existence of significant disparities in the levels of financial knowledge among 15-year-olds indicates that not all students have the same opportunities to develop their financial skills. If the socio-economic disparities are not addressed early, the financial literacy gaps are likely to widen further as these students become adults. It’s therefore essential to support the lowest-performing and most disadvantaged students to ensure that they can cope with an increasingly digitised financial system with confidence as they acquire independence.

Financial education in developing countries plays a crucial role because, in addition to enhancing people’s financial skills and knowledge, it contributes to promoting financial inclusion, one of the pillars of global development, and sustainable economic development.

The good news is that the results of some current literacy programmes are quite positive. Thus, according to an IDB report that conducted a meta-analysis of 14 randomised controlled studies of youth programmes in both developed and developing countries, the compulsory financial literacy programmes offering material which is standalone or integrated into other school courses display 0.24 standard deviations (SD) with respect to the size of the average effect on financial knowledge. This is a very large impact, particularly if we consider that even the best interventions aimed at improving mathematics and language often have a much smaller impact totalling just 0.10 SD.

These achievements are evenly distributed, as all the students improve their knowledge at similar rates, regardless of their initial grades.

In addition to acquiring financial literacy, the children also enhance important habits and personality traits. For example, the adolescents who took part in a secondary school programme recorded an 18% increase in their self-control, a key social-emotional factor when making sound financial decisions. Moreover, these young people were more likely to compare prices before buying, save instead of borrowing to buy things they couldn’t afford and engage in conversations about financial decisions with their parents.

Similarly, another recent IDB study has shown indirect effects on parents’ financial behaviour. Financial education lessons at school have considerable effects on the financial behaviour of parents in disadvantaged households. Among parents in the poorest households, the treatment reduces the likelihood of default by 26%, increases the credit scores by 5% and raises the current debt levels by 40%.

Financial education in vulnerable environments has the potential to have a transformational impact. Empowering children and young people to make informed and responsible decisions in their financial lives is making it easier for them to take control of their own lives, which also contributes to building a secure future for them, their families and their community. The support for financial education in these environments must therefore be regarded as a critical long-term investment in the development of human capital and it must be backed up by key players in the public, private and civil fields. By doing so, the foundations will be laid for sustainable growth and greater equity in society.

References

INFE (OECD). (2008). Financial Education in School.

Frisancho, V. (2019). “The surprising impact of teaching financial literacy in schools.” Blog titled Ideas that count. IDB.

Frisancho, V. (2023). Spillover Effects of Financial Education: The Impact of School-based Programs on Parents. IDB Working Paper Series. IDB-WP-1452.

OECD (2017), “What do 15-year-olds really know about money?”, PISA in Focus, No. 72, OECD Publishing, Paris, https://doi.org/10.1787/21dc1a9a-en.